An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Percentage of 15-29 year-olds with income from employment among all 15-29 year-olds by student status.

2022 Income Tax Return Filing Programme Issued Ey Malaysia

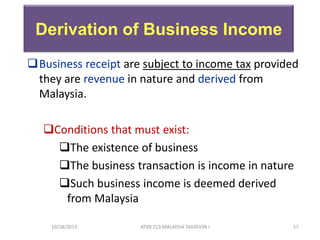

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)

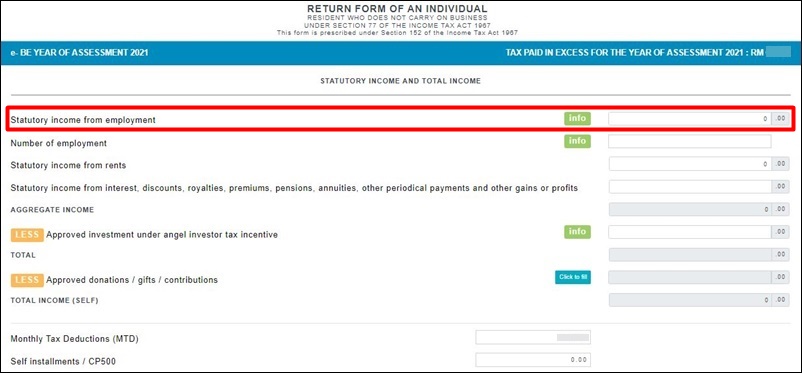

. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Total income 44 A. Paid Sick pay in Malaysia is set in the employment contract as dependent upon the years of employment and the provision of a professional medical certificate.

Participants who receive wages PPU who experience layoffs. Early Re-Employment Allowance - for JSA recipients to get back into the workforce. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -Any employee as long as his month wages is less than RM200000 and.

The following information are required to fill up the Form E. Chargeable income and aggregation of husbands and wifes income 45 A. However the Malaysia Long Term Social Visit Pass is most commonly issued to the spousesfamily members of Malaysians or Malaysian foreign residents which is why its known as a Malaysia spouse visa.

From an employment received in respect of having or exercising the employment in Malaysia. Salaries wages allowance incentives etc to be included in the CP8D form. Details of Public Revenue - Mongolia.

Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20000 per YA for a period of three consecutive YAs for a new SME or LLP which fulfils the requirements specified in Section 6D andor any other conditions which may be imposed by the Minister via a statutory order. In Malaysia the statutory maternity paid leave period for employees in the private sector is 90 consecutive days. For the employee who does not cover by the EA his employment relationship with the employer boiled down to the employment contract or.

Top statutory personal income tax rates. A new piece of legislation which provides an additional statutory benefit to employees is the Employment Insurance System Act 2017 EIS which was passed by the Dewan Rakyat on 26 October 2017. Employees work in return for wages which can be paid.

Career counselling - job search assisted by SOCSO. Who Is Eligible For EIS In Malaysia. This article is dedicated to all the employers employees or the soon-to-be employers or employees in Malaysia.

Employee Income Tax. The Employment Act 1955 is the main legislation on labour matters in Malaysia. There are also other monthly contributions that an employer is legally obligated to contribute or to pay on behalf of the employee.

However in the event the Employees monthly income exceeds RM4000 the contribution required would only be based on RM4000 per month. Carry-back losses Chapter 7Chargeable income 45. Or b regardless of income are employed as manual labourers or supervisors of manual labourers.

Aggregate income ascertained in accordance with the ITA. In general business enterprise tax is assessed on business income in excess of JPY 29 million at a rate of 3 4 or 5 depending on the type of business. 38 Adjusted income in relation to a source and a basis period means adjusted income ascertained in accordance with the ITA.

This is applicable on payments made to residents of all the treaty partners listed except for certain countries including Germany Turkmenistan Bosnia and Herzegovina Senegal and Jordan where the respective tax treaties have provided for such type of income to be taxed only in the. 37 Statutory income in relation to a person a source and a year of assessment means statutory income ascertained in accordance with the ITA. Relevant Provisions of the Law The provisions of the Income Tax Act 1967 ITA related to this PR are sections 2 7 13 25 77 82 82A 83 112 113 119A 120 paragraph 4b and Schedule 6.

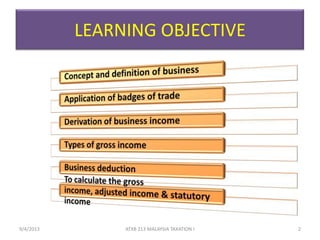

Income received from the commercialisation of a scientific research finding is given tax exemption of 50 on the statutory income in the basis year for a. An employment source. Statutory income Chapter 6Aggregate income and total income 43.

Currently the EA 1955 only applies to employees who. Find out which income can be exempted from income tax in Malaysia for 2022. Teachers and school heads statutory salaries.

Up to 5000 MYR. Capital gains are in principle aggregated with other income after deductions for necessary expenses and after a statutory deduction of a maximum of JPY 500000. A earn less than RM2000 approx.

Targeted statutory corporate income tax rate. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Before we get into the claimable allowance you must first know that not everyone is eligible to claim.

Percentage of full-time full-year earners part-time earners and people with no earnings by educational attainment. Such monthly contributions are also known as statutory contributions because they are provided in the statutes or the Act of. In Malaysia the monetary costs of hiring an employee are not merely confined to his or her monthly salary.

Statutory corporate income tax rate. The employment law in the private sector in Malaysia is mainly provided in the Employment Act 1955 the EA. Form E is a declaration report of companies to inform the LHDN Inland Revenue Board on employees numbers status and the list of employees income details.

Employment in general government and public corporations. Summary of Employment Laws in Malaysia EMPLOYMENT ACT 1955. Malaysia follows a progressive tax rate from 0 to 28.

The full amount of gratuity received by an employee on retirement from employment is exempt if. Group relief for companies 44 B. Unregister Health Insurance Program in the event of Termination of Employment PHK.

Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work. Chapter 5Statutory income Section 42. Deduction for husband 46.

Employment is a relationship between two parties regulating the provision of paid labour services. Re-Employment Placement Programme - job search assisted by SOCSO. Amendments to the Malaysian Employment Act 1955 EA 1955 will provide further protection and benefits to employees.

Korea Statutory Update Income Tax Table Update 2021. The rate of WHT on such income is 10. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia.

Thursday April 15th 2021. It is issued to the family members of Employment Pass holders or spouses of Malaysian citizens as well as to foreigners who need to undergo medical treatment in Malaysia. Teachers statutory salaries at different points in teachers careers.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Details of Public Revenue - Maldives.

What Is Taxable Income And How To Calculate It Forbes Advisor

Chapter 6 Business Income Students 1

Tax Exemptions What Part Of Your Income Is Taxable

Individual Income Tax In Malaysia For Expatriates

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To File Taxes For Self Employed Freelancers And Gig Workers Malaysia

Corporate Income Tax In Malaysia Acclime Malaysia

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Software Tax

Malaysia Companies With Flexible Work Arrangements Now Eligible For Income Tax Deductions

Malaysia Personal Income Tax Guide 2021 Ya 2020

What Is Net Income Definition How To Calculate It Bankrate

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Chapter 6 Business Income Students

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Calculate Your Chargeable Or Taxable Income For Income Tax